Episode 4

March 15th, 2021

Welcome back everyone — we know you have grown acclimated to having tech clowns in your inbox on Sundays, but we wanted to try something new this week and send on Monday. Anywho, to the fun stuff!

So… What Exactly is an NFT?

A bubble? A cryptocurrency? Art? Well, yes, sort of, but also no, maybe not. A non-fungible token (NFT) is an asset linked to a digital object. In essence, it’s a unique, non-duplicable digital certificate of ownership that proves that you own the underlying piece in question. Where is this digital certificate recorded?

Not to sound like a lawyer (this newsletter is run by clowns after all), but it depends. Once the code underlying this certificate is written, it’s “minted” on a blockchain, a digital ledger that records the certificate's ownership and transferals. The Ethereum blockchain is the most popular, but other ones like Flow by Dapper Labs are well established at this point as well.

So, what’s an actual use-case of this, and why did someone buy an NFT for $69M? Let’s look at the NBA Top Shot, a new-ish NFT company that did $200M(!) in revenue last month. Similar to how traditional sports memorabilia collectors purchase physical packs of cards, NBA Top Shot customers buy digital packs. However, instead of physical cards, you get “Moments” of players, which are 10-second clips of gameplay featuring that player. My personal favorite is of Chris Paul making Isaiah Hartenstein wishing he never left the G-League. There’s also no need to list your cards on eBay when you’re trying to flip them for profit—you simply list Moments on the Top Shot Marketplace. Most importantly, instead of having to worry that the counterparty is scamming you with a janky card, you have confidence you aren’t being duped since each card’s ID is recorded on the underlying Flow blockchain.

Due to the ridiculous amount of hype Top Shot has received, the potential to flip Moments for a profit is colossal. I recently purchased a pack for $14—you have to wait in a digital line since they’re in such high demand—and sold two of the enclosed Moments for $220. It’s like waiting outside Supreme to resell but with less exposure to teenagers hitting their juuls!

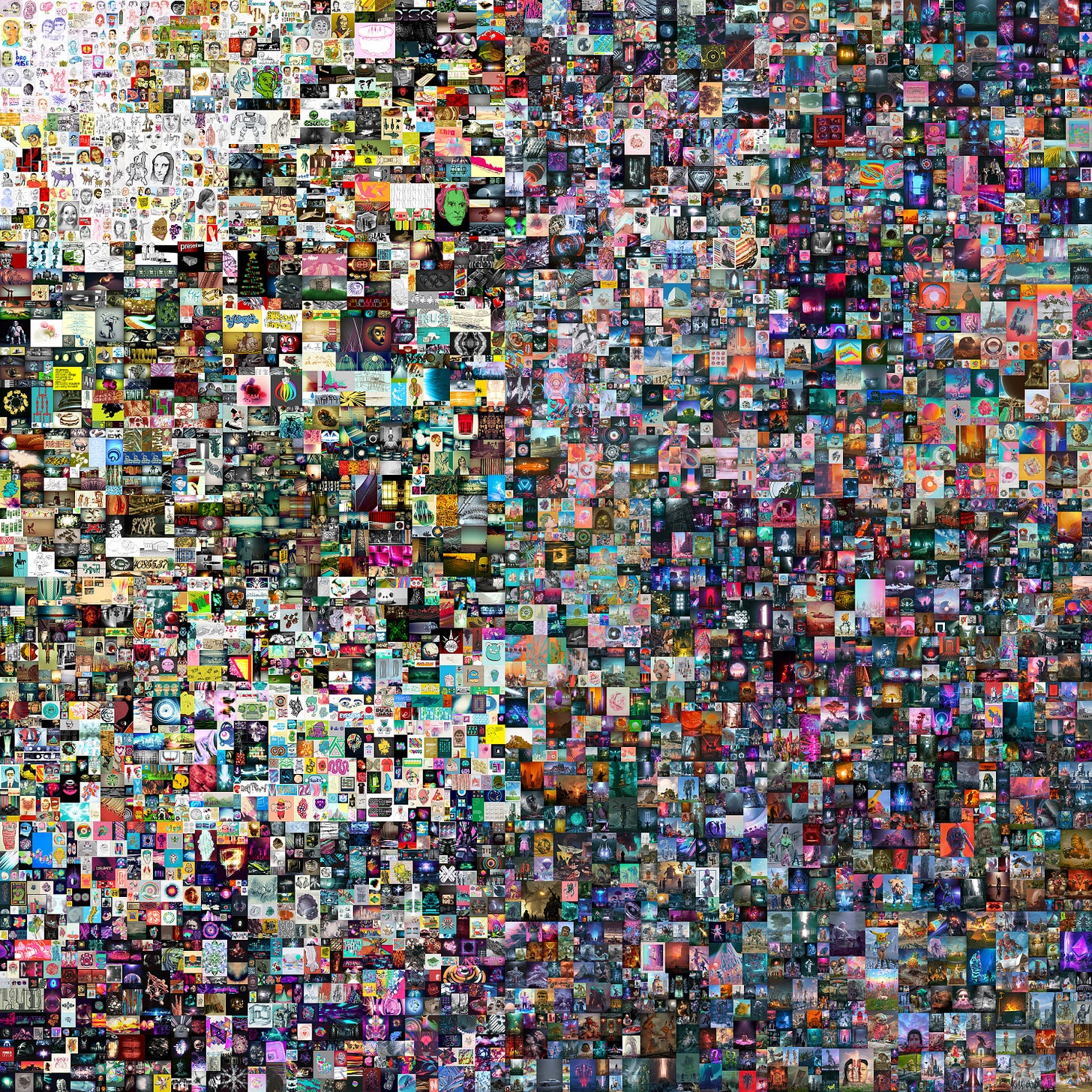

That brings us back around to the infamous $69M auction held by Christie’s earlier this month. Mike Winkelmann, also known as Beeple, is an amalgamation of thousands of images highlighting his journey as a digital artist. After 353 bids, someone who goes by the pseudonym the Metakovan secured the piece.

There’s a lot to unpack here.

First, NFTs are the Wild West right now when it comes to how they fit under existing legal regimes. I’m not entirely sure how OpenSea—the largest NFT marketplace that just raised a spicy $20M from VCs—would react if I minted a bunch of Pokemon-related NFTs and Nintendo subsequently requested to take them down. What if some had sold before they could take them down? One of the blockchain pros suddenly becomes a huge downside; once it’s on the blockchain, it’s almost impossible to remove. While this Pokémon example is admittedly a little frivolous, imagine if the NFT was a screen-recording of someone’s Onlyfans account or a pornographic deepfake made without someone’s consent.

5000 Days by Beeple

Additionally, do NFTs have long-term value, or is this the beanie-baby bubble all over again? After watching people snicker and call Bitcoin a bubble, I’m hesitant to believe there is absolutely no underlying value here. On the other hand, the ICO boom of 2017 was almost certainly a bubble, even if a few gems came from that destruction.

Andreesen Horowitz lays out a persuasive thesis that NFTs provide creators with a new way to better monetize from devout fans. For example, while Elon Musk fanboys might buy his cars, they might also be willing to purchase an Elon Musk gif NFT for millions of dollars. Black artists who are routinely excluded from showrooms might now have access to potential bidders since exhibitions can now take place digitally. This also turns customers into owners themselves, creating a secondary marketplace and more emotional investment in the ecosystem and the creator.

Whatever you think of NFTs now, we’re only in the infancy of a very nascent ecosystem, and the hype will only continue for a while.

There’s a New Technoking in Town

Straight gold. Tesla filed an SEC filing changing the titles of Elon Musk and Zach Kirkhorn, Tesla’s Chief Financial Officer. We hereby shall now address Musk as Technoking of Tesla and Kirkhorn as Master of Coin. Here’s the filing.

I don’t know. Perhaps Musk’s NFT prospects just got that much more royal.

Section 230 & Viewpoint Neutrality

A common thread I hear on Section 230 is concerning political censorship. Now, politicians have claimed that Section 230 mandates (or should mandate) political viewpoint neutrality.

Regarding the current status of the law, this is…wrong? Nowhere in the law can anyone find the words neutral, political, or anything of the kind.

Now, states have proposed bills demanding that platforms must be politically neutral, avoid censorship, and show arguments from both political sides, like here, here, and here.

Let’s set aside the blatant First Amendment problems with this type of legislation.1 The First Amendment is a cop-out in many conversations, especially those centered around online speech. Whenever you talk about the elephant in the room, a common refrain is that this is a First Amendment violation, you get dunked on, and the conversation ends. They could be right,2, but if we constrain discussions to that, then we dodge debating the merits of the problem to begin with.

So let’s play this out for a second because there is real merit to the concerns that the promoters of the law have. A quick history lesson.

Beginning in the 1950s, the Federal Communications Commission required cable networks to allocate equal on-air time to both sides of social and political issues. Scarcity was a key reason for this. Cable licenses were scarce, and the government was interested in airing both sides to prevent cable networks from being an instrument of particular sides and having a well-informed electorate. Fair enough.

The FCC gave up on the rule after a while during the Reagan administration, and shortly thereafter, we had the birth of…Fox News. And Rush Limbaugh.

Now, we live in a different technological environment. Most people get their news from Twitter or Facebook. These platforms curate our feeds for us based on our preferences. If I keep reading articles about NFTs and the blockchain and interacting with finance folks, these platforms respond by giving me more finance stuff. Same result if I read articles about how Obama was born in Kenya or articles critical of Trump.

Network scarcity isn’t an issue anymore, but attention scarcity is, and that scarcity is distributed based on the curation of my feed. Put nicely, the liberalization of the internet created both an echo chamber and a polarization problem.

Here’s an excellent visual tool that demonstrates the problem better than I ever could explain.

The feeds reaffirm our biases, and we lose touch with the issues that the other side may have, and our discussions become more polarized in person.

But even assuming the concerns are valid and that flavor of law would be constitutional, there are practical concerns.

First: false equivalency. Sure, I guess there are two sides to every argument, but there are still facts. “Everyone has his/her own opinion,” says the person who, I don’t know, says the Holocaust never happened. That’s a dangerous place to be.

Second: who decides when content constitutes facts vs. opinion? The government? The private platforms? On the one hand, a fundamental value in a democratic republic is a distrust of government. On the other, private platforms have commercial interests and legal duties to maximize shareholder value, and those interests may conflict with important individual rights.

Finally: how do you define or enforce neutrality? Does the weight of the “left” and the “right” of issues need to net out to zero magically?

I don’t know what the solution should be. But I do know this: these problems are hard and we need to abstain from jumping to conclusions quickly and traditional means of thinking.

If you liked our clownery this week, remember to hit the heart button up top, it helps pay the bills (not really). Feel free to reach out to email us at amettry@jd21.law.harvard.edu or clansang@jd22.law.harvard.edu if you have any suggestions or want to chat!

Needless to say, this type of legislation is patently unconstitutional under any interpretation of the First Amendment because a) companies (and platforms) have free expression rights and b) the government can only compel companies to speak under narrow circumstances (think FDA labels, etc.)